Denver Accounting Firm: Denver Tax Return Tips For Midyear

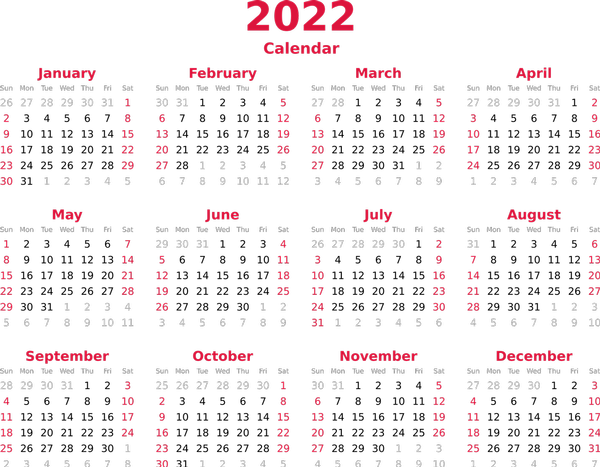

It’s hard to believe that just a few short months ago, tax season was winding down minus those who filed for an extension. While a majority of individuals elect to send in their returns prior to the well known April 15 deadline, those who did not have the paperwork ready to file could receive a six month extension by requesting such action during the initial period. However, for most individuals the focus now turns to the next filing season at some point around mid-year which is fast approaching.

Being able to prepare for the upcoming tax filing season ahead of time can be especially beneficial. By ensuring you are prepped and ready, the tax season frustration many experience may be a bit easier to navigate than preceding filings. By starting early, taxpayers can ensure they are taking all of the appropriate steps to ensure a smooth filing when the time arrives. Â

Â

Review

Before beginning to prepare for the next tax season, the present presents a great opportunity for reviewing your past filing. Depending on your personal situation, the differences may be extreme or non-existent but understanding how your current situation may impact next year’s filing compared to the last can help you prepare.

Â

Hire

If you don’t currently have a preferred tax preparer, then summer may be the best time to find one. Not only will potential suitors not be covered with timely returns, but you also typically aren’t facing any personal deadlines. Taking your time to find the right fit for your situation and filing, could pay off in the long run.

Â

Withholding

Depending on the results from your previous filing, a change to your withholdings may be warranted. If you haven’t made such a move, then the mid-year time period presents a grand opportunity to reap the benefits of an adjustment to the withholding category for any upcoming payments.

Â

Plan

Finally, now is the perfect time to create a plan moving forward. If you suspect the tax results from a prior year’s filing may be dramatically different due to either a filing status change, income revision, or retirement finances, then making adjustments now could help to avoid a bit of “sticker shock†when the return is filed next year.

If ready to capitalize on the multiple benefits of having professional tax assistance for your business or personal needs, are needing to file a return, or have any other tax related questions then let the professionals at Bloch Rothman and Associates assist you today. In addition to providing answers for your questions, they can also take care of multiple other issues dealing with paying or owing back taxes, required audits signaled by either the IRS or an outside agency, or any other personal or corporate wealth management issues. Along with providing a top quality tax service, our group can also complete all types of returns and get answers to any other factors associated with financial issues or concerns you may have. Serving Denver and all of the surrounding areas for 35 years, our firm has an extensive history in helping clients with any and all of their tax issues or dealings with the Internal Revenue Service. If you have questions about your personal, business, estate, or any other filings, don’t hesitate to contact us today. Available for all of your tax needs, there are also a number of bookkeeping and payroll services offered to assist you and your business. We look forward to meeting you and providing the type of service you can rely on whatever your needs may be very soon!